RealValue EMI Engine Use Cases

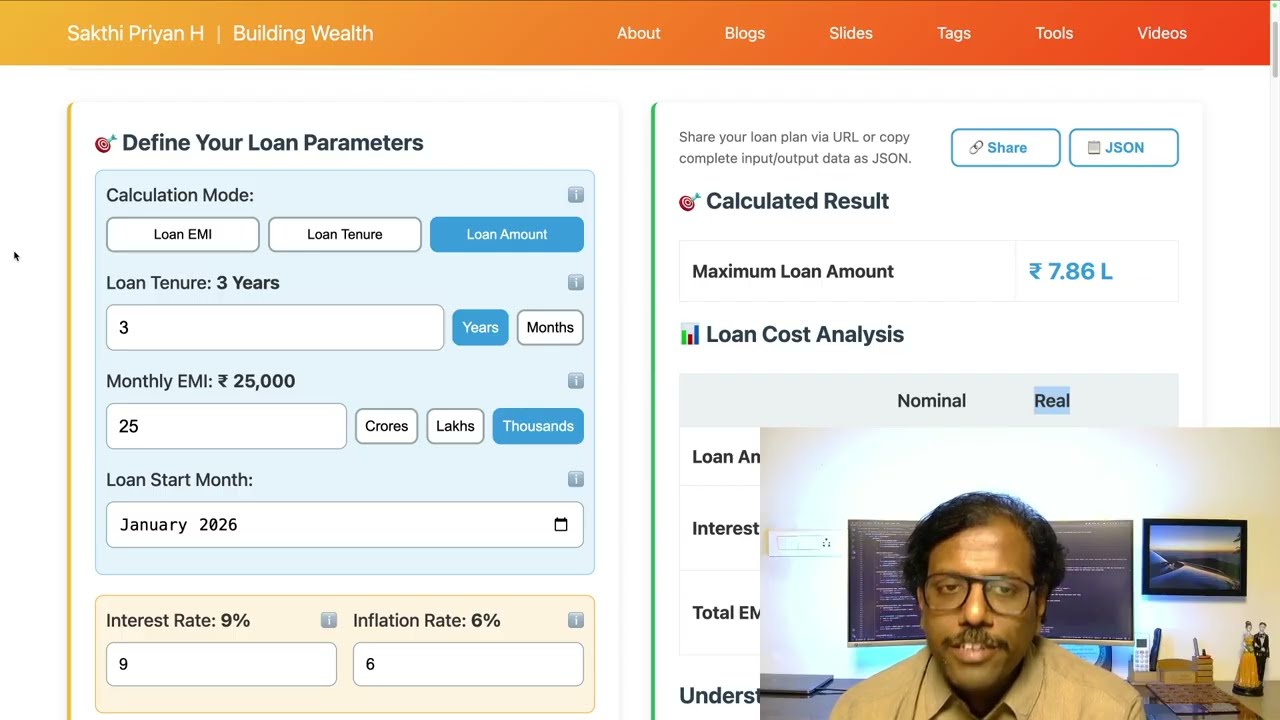

Discover real-world scenarios showing how to use the RealValue EMI Engine for home loans, car loans, personal loans, and understanding the true cost of debt with inflation-adjusted calculations.

Learn about investment strategies, financial planning, and wealth building techniques to secure your financial future.

Discover real-world scenarios showing how to use the RealValue EMI Engine for home loans, car loans, personal loans, and understanding the true cost of debt with inflation-adjusted calculations.

Discover real-world scenarios showing how to use the RealValue SIP Engine for retirement planning, education goals, house down payments, emergency funds, and more.

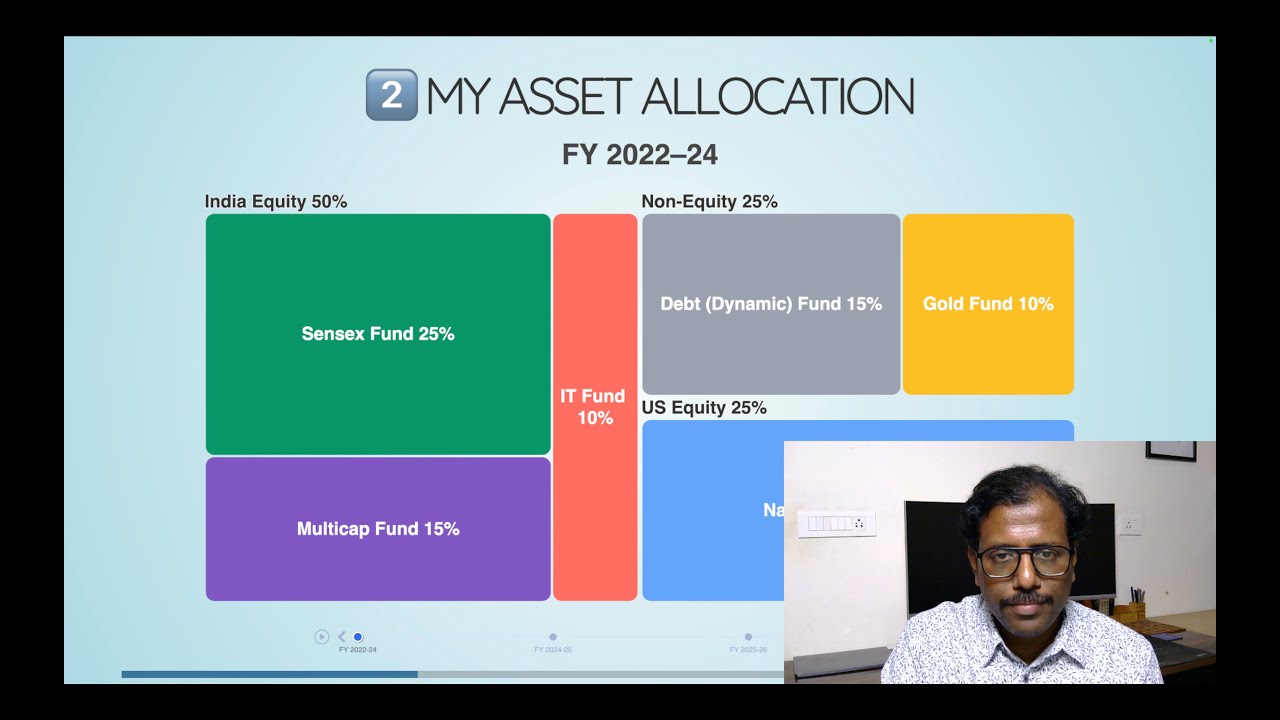

A comparison between a typical multicap/flexicap fund and a globally diversified, rule-based multi-asset allocation strategy.

Why your ₹1 Crore target might need ₹1.79 Crores — inflation, tax, and the truth about wealth planning.

Understanding when and how to use debt strategically for building wealth.

Credit cards can be powerful tools for rewards, convenience, and short-term liquidity when used with discipline.

How early financial decisions can create huge long-term opportunity costs.

How early financial decisions can create huge long-term opportunity costs.

Learn the best ways to use Debt investment for short term, long term and portfolio asset allocation

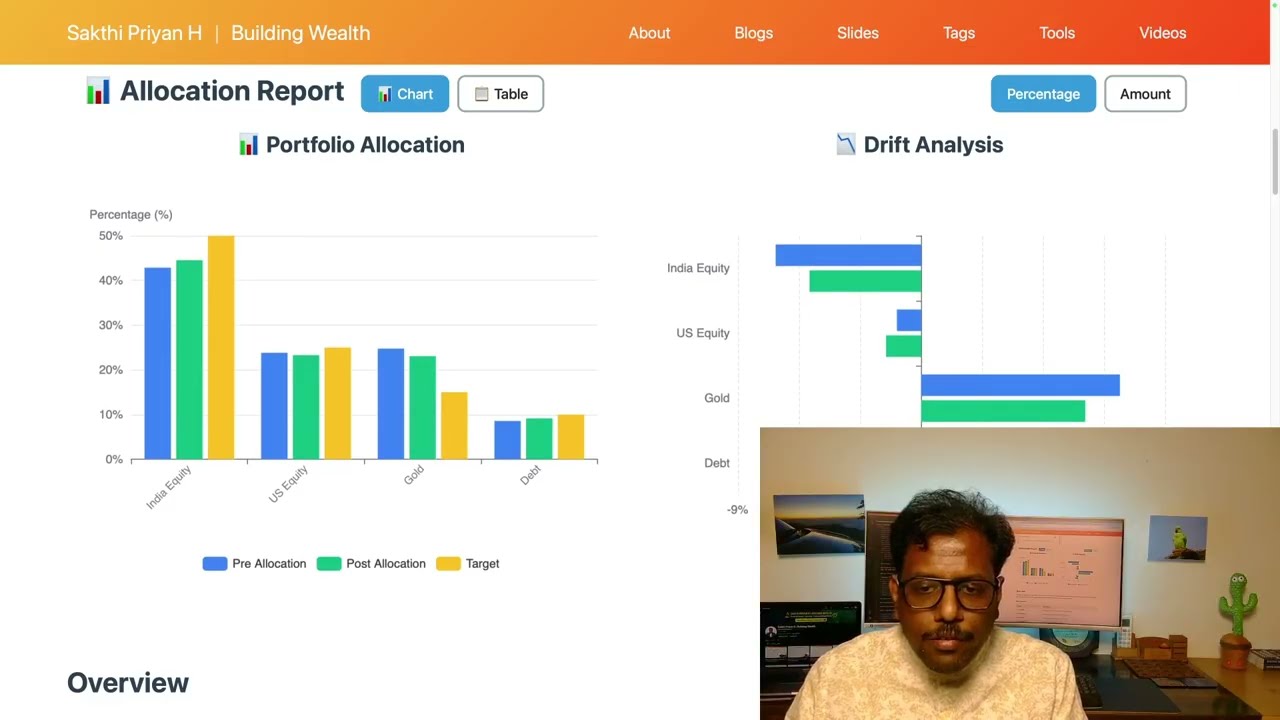

A smart cashflow rebalancing engine that minimizes allocation drift across investors, with built-in tax-slab optimization and automated international TCS handling.

Understand your loan’s true cost with real (inflation-adjusted) value projections and EMI burden visualizations.

Plan your systematic investment with real (inflation-adjusted) value projections and comprehensive growth visualizations.

Plan your emergency fund and calculate the timeline to reach your savings goal.

TBD

TBD

Discover how to intelligently allocate monthly SIPs across multiple family members, optimize for tax slabs, handle international assets with TCS, and rebalance portfolios using cashflow—all without selling existing holdings.

9:17

9:17

Understand the real (inflation-adjusted) cost of loans in India using the RealValue EMI Engine — see what you truly pay over time, post-tax and post-inflation.

15:13

15:13

Understanding the difference between smart loans and bad loans. Learn when debt can be a powerful tool for wealth creation and when it becomes a burden.

18:40

18:40

Complete walkthrough of the RealValue SIP Engine — a powerful investment planning tool that shows real (inflation-adjusted) returns, handles multiple goal types, and provides comprehensive financial projections.

13:05

13:05

Credit cards can be powerful tools for rewards, convenience, and short-term liquidity when used with discipline.

15:29

15:29

A practical breakdown of how I allocate my portfolio across India, US, Debt, and Gold — and my simple, tax-efficient rebalancing method using monthly cash flow.